If you’re homeschooling a teen, you know that equipping them for long-term success of adulthood means they need a lot more than just a few math, literature, and science credits. They need to know how to make a myriad of ordinary (yet vital) decisions every day, from budgeting to insurance to avoiding debt. Including personal finance instruction in the form of a consumer math homeschool curriculum can be a great option for many teens! Keep reading for a full review of Master Books Consumer Math homeschool curriculum as well as a GIVEAWAY!

This post contains affiliate links. I received a product for free, and was compensated for my time. All opinions are honest and my own; I was not required to write a positive review. Please see disclaimer.

- What is Consumer Math?

- Can I use Consumer Math as a High School Credit?

- What is covered by the Consumer Math homeschool curriculum from Master Books?

- Pros and Cons of Master Books Consumer Math

- Master Books Consumer Math Giveaway

- You may also enjoy:

What is Consumer Math?

Consumer math teaches students how to apply math skills to real-life practical, financial situations. It covers topics like income and employment, budgeting, saving, banking, credit and debt management, housing, transportation, taxes, insurance, and everyday purchases.

For the Christian homeschooler, we will also want to include discussion of stewardship, contentment, and other aspects of how a Biblical worldview impacts the way we think about our money and other resources.

Have you ever heard an adult bemoan the fact they learned a lot about parallelograms in high school but next to nothing about managing their money?

It’s important for teens to take consumer math because it equips them with practical skills they’ll use every day as adults. It helps them:

- Understand real-world money decisions (like budgeting, saving, and paying bills)

- Avoid common financial pitfalls (such as credit card debt or poor loan choices)

- Build confidence and independence in managing their own finances

- Prepare for life after high school (whether they go to college or begin their career)

By learning how money works now, teens are better prepared to make wise financial choices later.

Can I use Consumer Math as a High School Credit?

It’s important to understand what constitutes a high school credit. First, you need to know and understand any legal homeschool requirements you need to follow in your state.

You may have also heard about the Carnegie unit, which typically defines one credit as ~120-180 hours of study, taking into account instruction time, homework, projects, tests, etc. Now, that includes reading, writing, discussing, projects, etc. Unless your state law specifically requires it, however, you probably don’t need to log time.

Basic high school graduation suggestions often include:

- 4 credits English

- 3-4 credits Math

- 3-4 credits Science

- 3-4 credits Social Studies

- 1-2 credits Foreign Language

- Several elective credits

For most college-bound teens, you likely need to plan to reach Precalculus at a minimum by the end of high school. But for those teens who may have alternative plans after graduation, a consumer math course could count as one of their high school math credits.

But every teen needs to have a solid foundation in financial literacy before they leave home! Even if you plan to pursue a more traditional 3-4 year math schedule for high school, I highly recommend including some sort of consumer math course in Jr High or High School. It can not only count as an elective credit but also provide a solid foundation for adult life!

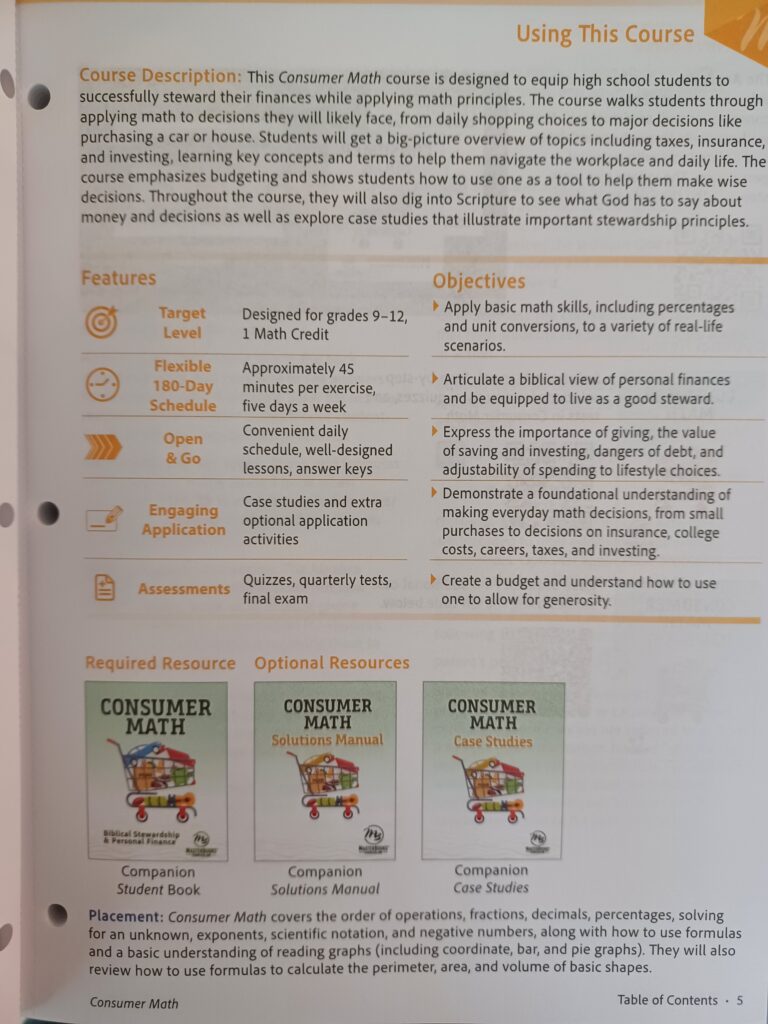

What is covered by the Consumer Math homeschool curriculum from Master Books?

Consumer Math from Master Books curriculum does not require any previous high school level math instruction. Master Books suggests a student has taken pre-Algebra previously. I noticed, however, that the first lesson includes basic skills reviews for addition, subtraction, multiplication, division, percentage, etc.

The calculations used throughout the text and worksheets are all based on those basic operations. A confident math student with a solid foundation in elementary math should have no trouble successfully navigating this course in 7th or 8th grade. For a struggling learner, it would be a gentle math credit in high school. And I think most teens would be able to incorporate this as an elective course in addition to their more challenging math courses.

Table of Contents: Consumer Math Curriculum Overview

The curriculum is divided into four quarters, 20 lessons, and 180 days worth of worksheets and tests.

Quarter 1: The Big Picture and Key Skills

Lesson 1: Introduction & Giving

- The Big Picture

- Skill Review: Addition & Subtraction, Time Abbreviations

- Skill Review: Multiplication & Division

- Income Distribution Equation

- Skill Review: Rounding & Percent

- Giving & Calculating a Percent of a Value

- Percentage Given

- The Methods & Heart of Giving

- Review & Case Study

Lesson 2: Introduction to Living Expenses

- Living Expenses= Needs vs. Wants: Lifestyle Choices

- Mental Math: Addition & Subtraction

- Lifestyle Choice & Unit Price

- Mental Math: Multiplication & Division

- Skill Review: Percent Off & Finding Half

- Mental Percent Problems

- Subscriptions

- Utility Bills

- Review

Lesson 3: Savings, Compound Interest, & Debt

- The Importance of Saving

- Understanding Interest

- Skill Review: Order of Operations & Compound Interest Formula

- Calculating Compound Interest

- The Dangers of Debt

- Credit Cards & Credit Card Debt

- Home Debt

- Credit Scores

- Review & Spiritual Debt

Lesson 4: Taxes

- Flat Tax (Sales, Social Security, Medicare)

- Progressive Tax

- Different Incomes on Federal Taxes

- Filing Status

- Deductions

- Tax Tables

- Deductions and Credits

- Total Due or Refund

- Review

Lesson 5: More Taxes & Review

- Effective & Marginal Tax Rates

- Compiling Income

- State Income Tax

- Review

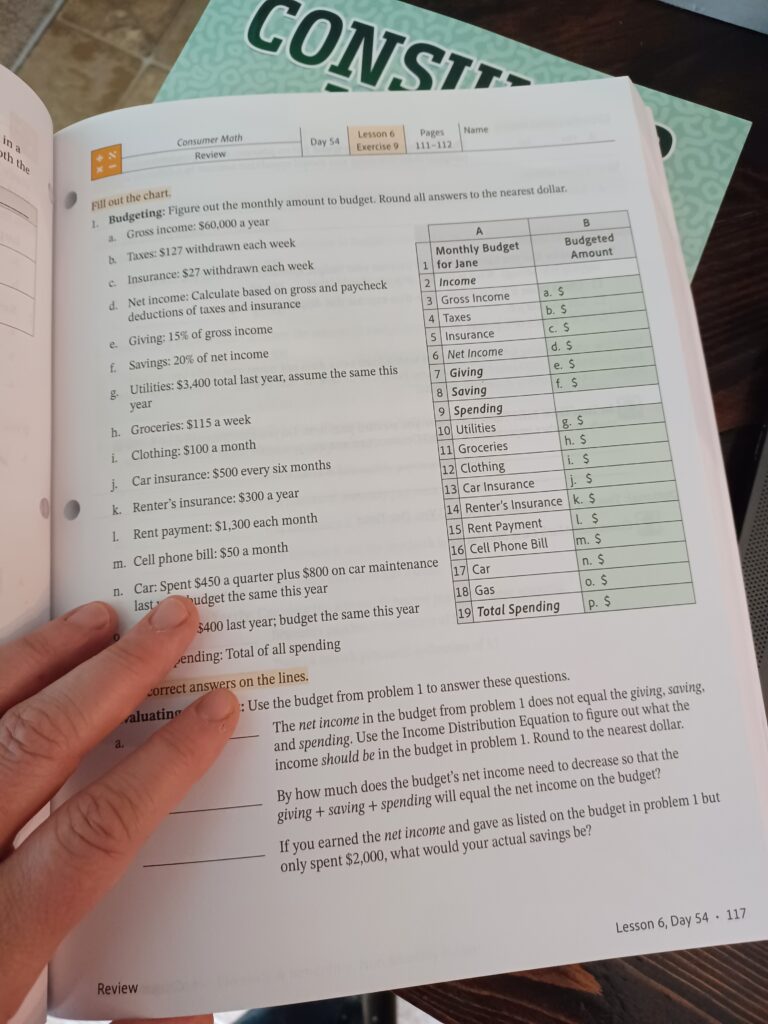

Quarter 2: Budgeting

Lesson 6: Getting Started with a Budget

- Introducing Budgets

- Skill Intro: Spreadsheets

- Understanding Gross vs. Net Income

- Estimating Fixed vs. Variable Expenses

- More Spreadsheet Practice

- Evaluating a Budget

- Budget Tools

- Creating Your First Budget

- Review

Lesson 7: Income Budgeting & Limiting Lifestyle (Food)

- Estimating Income: Biweekly/Bimonthly; Non-Monthly Budgets

- Estimating Income: Hourly, Self-Employment, Commission

- Lifestyle Review: Food Cost

- Eating Out vs. In

- Meal Planning & Estimating

- Dish, Brand, & Effort Choices

- Sales & Stocking Up

- Review & Case Study

Lesson 8: Medical Expenses & Budgeting

- Medical Expenses

- Insurance, Sharing, & Discount Plans

- Key Terms: Deductibles, Coinsurance, etc.

- Insurance Types & Accessibility

- HSA & FSA

- Supplemental & Disability Insurance

- Budgeting Medical Costs

- Comparing Policies

- Review

Lesson 9: Big Expenses & Budgeting

- Saving for Big Expenses and Skill Sharpening: Units & Conversion

- Budgeting Events & Trips

- Area, Volume, and More Conversion Practice

- Scale Drawings & Circle Geometry

- Savings vs. Debt

- Home Improvement Costs

- Review & Case Study

Lesson 10: Review

- Prudent Saving vs. Wealth Accumulation

- Total Abandonment & Mental Sales Tax

- God’s Heart for the Poor

- Review & Case Study

Quarter 3: Financial Decisions

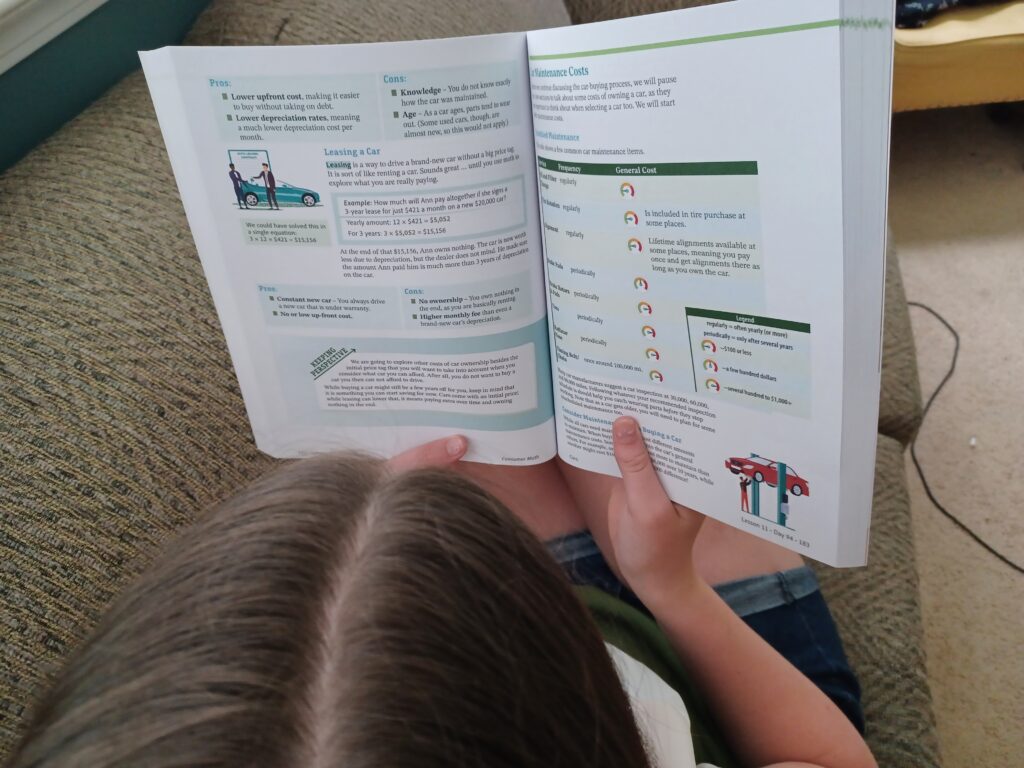

Lesson 11: Cars

- Transportation Options & Payments

- Depreciation & New Cars

- Cost Per Mile, Used Cars, Leasing

- Maintenance & Gas Mileage

- Car Insurance

- Total Car Cost (Including Hidden Fees)

- Making a Fair Deal

- Review & Case Study

Lesson 12: Career Preparation

- End Goals & Biblical View of Work

- College Costs, Credits, & Savings

- College: Ways to Save and Financial Aid

- Alternatives: Trade School, Apprenticeship

- Comparing Job Benefits & Compensation

- Self-Employment Income

- Review & Case Study

Lesson 13: Housing, Part 1

- Comparing Rentals

- Saving to Buy

- Affording Housing

- Mortgages & Equity

- Loan Qualification

- Mortgage Types & Insurance

- Points & Lender Credits

- Renting vs. Buying

- Review & Case Study

Lesson 14: Housing, Part 2

- Realtors & Key Terms

- Closing Costs

- Location & Fixer Uppers

- New vs. Resale Costs

- Homeowner’s Insurance

- Home Maintenance

- Total Cost Evaluation

- Refinancing

- Review & Case Study

Lesson 15: Decisions & Review

- Decision Making & Case Study

- Umbrella Policy

- Struggles & Finances

- Skill Sharpening: Negative Numbers & Graphs

- Review

Quarter 4: Applications, Investments, & Final Review

Lesson 16: Applying Math Skills to Daily Life

- Doubling/Halving Recipes

- Pan Size Adjustments

- Measurement Substitutions

- Unit Conversions (US, Metric, Currency, Temperature)

- Health & Nutrition

- Review & Case Study

Lesson 17: Investment Concepts

- Key Investment Concepts

- Supply/Demand

- Variable Investments with Positive ROI (Savings Accounts)

- Variable Investments with Positive or Negative ROI (Stocks)

- Fixed Income Invesements: CDs & Bonds

- Diversification

- Assets and Direct Investments

- Review & Investing in Eternity

Lesson 18: Investment Mechanics & Retirement

- Investing Mechanics

- Annualized ROIs and Rule of 72

- Checking Accounts & Management

- Retirement Accounts (IRAs, 401ks)

- Inflation & Saving Enough

- Long-Term Insurance

- Other Financial Prep Tools

- Review

Lesson 19: Business Math & Taxes

- Estimating Taxes

- W-4 Form Completion

- Revenue, Expenses, & Profit

- Budgeting for Business

- Balance Sheets

- Self-Employment Taxes & Startup Costs

- Gambling & Stewardship

- Review

Lesson 20: Final Review

- Quarter Review & Case Study

- “Two Masters” Financial Reflection

- “Begin Now” Encouragement

- Reference Section

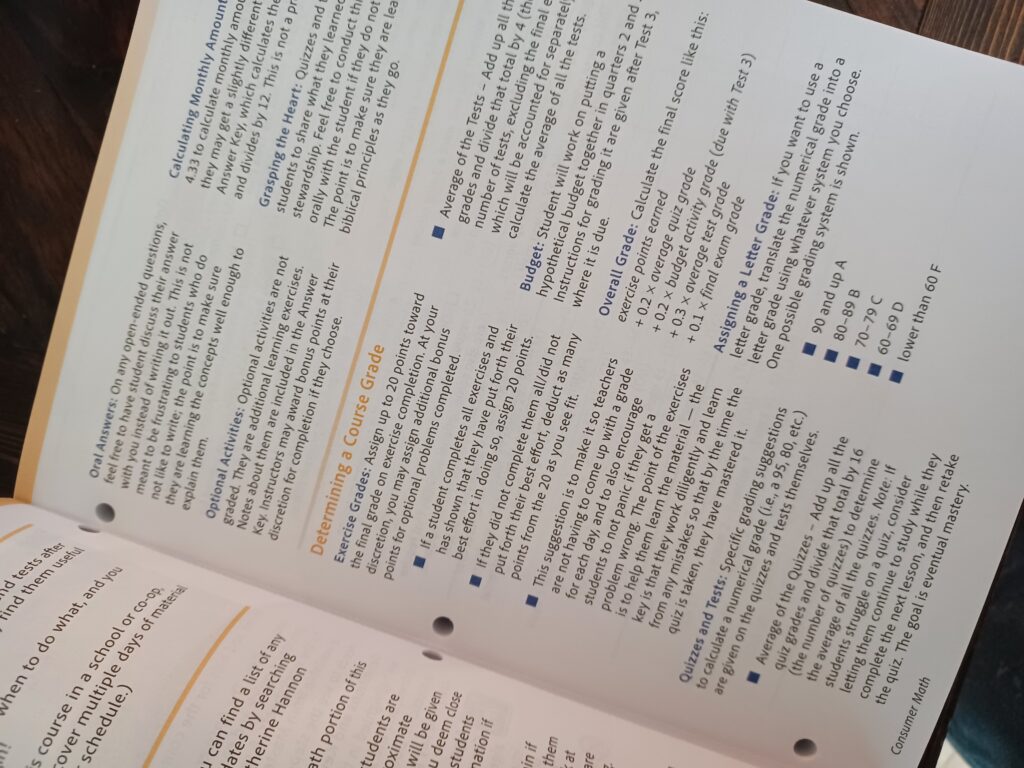

The student textbook includes all the instruction needed. I had one of my teens look through it, and she found it easy to read and understand. The teacher guide includes the weekly lesson schedule, quizzes and tests, daily student worksheets, and the answer key. The pages are perforated and hole punched, so it would be easy for you to pull out just the pages needed for each week without giving your student access to the answers.

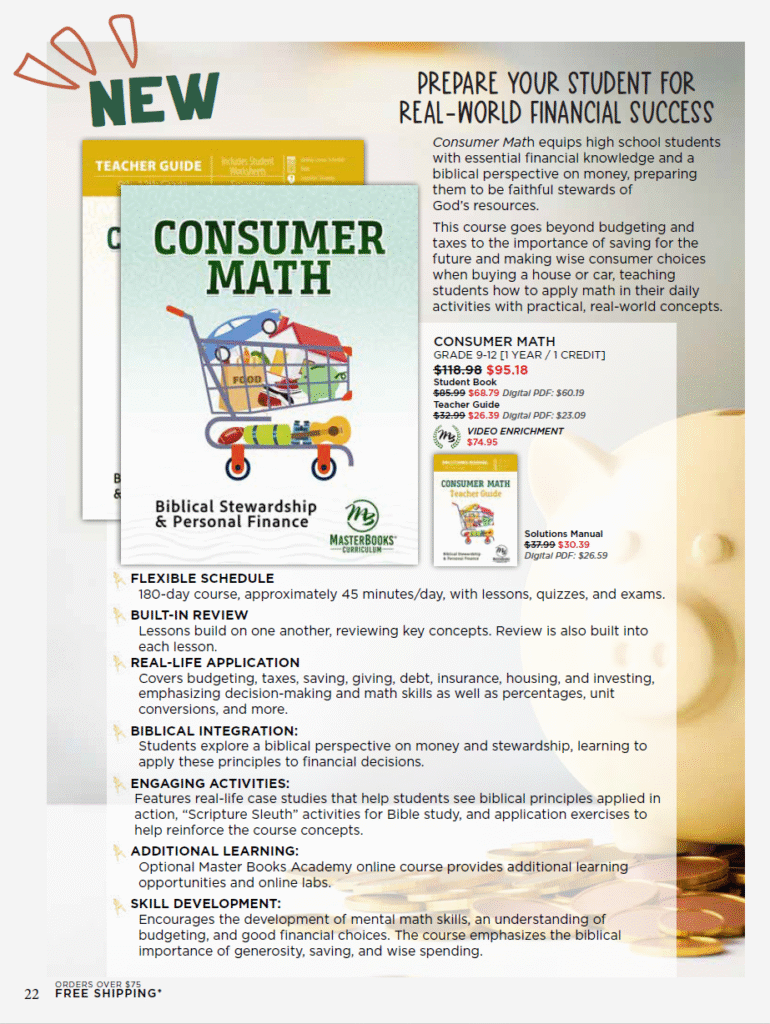

Pros and Cons of Master Books Consumer Math

If you are looking for an easy-to-use, open-and-go Consumer Math curriculum your teen can use independently, this will work well. With daily worksheets and regular quizzes/tests, it will be easy to grade. In fact, the teacher guide is a helpful resource for the parent in deciding how to plan daily assignments and the overall course grade.

I also really appreciate how Big Picture ideas are included throughout the text. For example, it’s not enough to just understand how to budget for items like clothing, housing, and food. It’s even more important to understand what the Bible has to say about being a good steward of our resources and having a content, joyful heart towards what God provides.

I also appreciate the reminder that giving and generosity is part of a Biblical ethic of responsible financial stewardship. In addition, the case studies give real-life stories of individuals and families implementing and experiencing the topics covered.

I do wish there had been a little bit more exploration and practice with reconciling a budget. There was 1 lesson near the end of the book that briefly mentioned it being important, but I think it would be helpful for students to get more practice on how to implement this skill.

I do have some concerns that Consumer Math might be chosen as an easier math high school credit when perhaps an alternate or additional math course might be a better fit for a student’s long-term academic goals. I wholeheartedly believe every teen should receive Consumer Math and financial literacy education. And I also believe many, if not most, teens should, in addition, be challenged to pursue a rigorous high school math curriculum. My personal recommendation for most teens is to use Consumer Math as an elective credit.

Master Books Consumer Math Giveaway

Enter for a chance to win the NEW Consumer Math from Master Books!

You may also enjoy:

- Counting Pennies, Reaping Riches

- 8 Simple Jobs For Homeschool Moms You Can Do Today

- MoneyTime: Financial Literacy for Kids Made Easy (with Neil Edmond)

- Healthy Eating on a Budget (an interview with Steph Jenkins)

- Budgeting for Homeschool Families: a video interview with Matt Miner (MBA, CFP®, and homeschool dad)